Building the Media Business of the Future

A first-principles, bottom-up exploration, and implications for investors, creatives and non-media founders.

This is a first-principles, bottom-up exploration of the kind of media business that will exist in 2030 and beyond. My interest in writing this piece is simple: I want to build a successful media business. It is as much a conversation with myself as it is with you. This piece is a result of years of thinking about the industry and working in it for the last 7 years, as a creative professional, investor and a founder.

We answer four questions in this piece

Will successful media business models exist in 2030 and beyond?

What form or shape will they take?

What will be the role of capital in building and scaling media businesses?

What are the implications for Investors, Creative Professionals and non-media founders?

You can skip to the relevant section directly, but I suggest you read the piece linearly.

Will successful media business models exist in 2030 and beyond?

Let’s begin by answering a more fundamental question: What is a media business?

Simply put, a media business concentrates Distribution1 in order to monetize it.

TV channels buy expensive satellite bandwidth to occupy a channel on your TV, and then sell ads to monetize that Distribution. A movie studio concentrates Distribution through its relationship with theatres. It is able to do so because of its ability to make movies with the biggest stars and the best directors. It then monetizes that Distribution by selling movie tickets. Newspapers invest upfront capital to set up printing presses, hire journalists, and then sell classifieds and ads. Concentrating Distribution is the absolute necessity for a media business to exist.

Traditional media businesses, like the ones mentioned above, used capital to concentrate Distribution. As long as capital was unevenly distributed, Distribution could be unevenly distributed, and therefore concentrated. Therefore, in the traditional setup, capital was the leading indicator of Distribution.

But that has changed.

New forms of media businesses don’t need capital to concentrate Distribution, because the internet has democratized the airwaves and pipelines of Distribution. Now, concentration of Distribution does not as much depend on capital, as much on the quality of work - Creativity2. In the new paradigm, concentration of Creativity is the leading indicator of concentration of Distribution, not capital.

This shift from capital-as-leading-indicator to Creativity-as-leading-indicator is the reason why traditional media businesses are struggling around the world. This paradigm shift exposed that capital in traditional media businesses was grossly misallocated.

So yes, media businesses will continue to exist and thrive in the future. As long as Creativity is unevenly distributed (which it is), Distribution will remain unevenly distributed, and therefore will continue to be concentrated by media businesses.

What form will successful media businesses take?

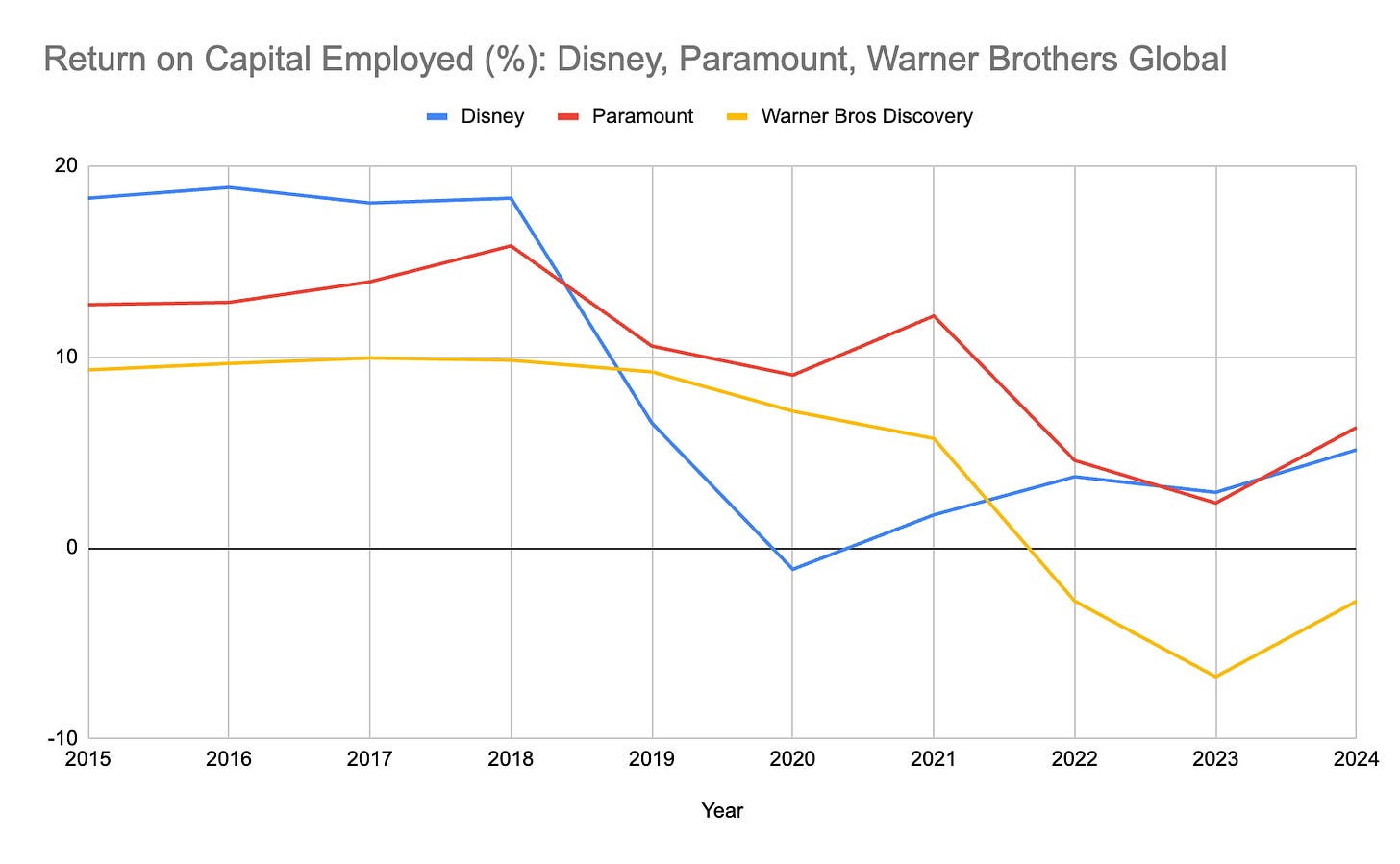

A good way to answer this question is to understand why precisely are the traditional media businesses - Big Media - struggling around the world? We touched upon this lightly above - capital misallocation. Simply put, the economic value that they are delivering through their products is misaligned to the amount of capital they are consuming. The chart below plots the Return-on-Capital-Employed (ROCE) for three of the biggest media conglomerates of the world - Disney, Paramount Global and Warner Brothers Discovery.

Notice the secular drop in ROCEs around the 2018-19 period when the paradigm shift accelerated. Despite consolidation, and transition from expensive traditional distribution to internet-led distribution, the media giants haven’t been able to successfully adapt to the new realities. The stock prices have reflected their underperformance with all three stocks remaining flat over the last 5 years, while the broader market rallied more than 100%.

A good proxy to understand this capital misallocation is to look at Big Media’s most expensive product - movies. The value that movies provide - emotional stimulation or “entertainment” - relative to the capital required to make a movie has become grossly misaligned, especially when thousand times cheaper media products - reels, tiktoks, youtube videos, podcasts - deliver near-similar value and are competing with movies for audience’s time and attention. Either or both need to happen for movies to remain relevant in the future - the cost of producing movies has to drastically come down, or they need to provide immensely superior emotional value compared to newer forms of media. This not only requires better financial management in making movies but also a creative reinvention of what a movie is.

The same is true for Big Media as a whole. Big Media has become excessively bloated with far too many non-creative parts that do not create any value. If concentration of Creativity - let’s call it Creative Density - is the leading indicator of concentration of Distribution, Big Media is not creatively dense enough - spread too thin with vestigal non-creative parts that only help in pushing paper instead of adding creative value. This is at the heart of the capital misallocation.

So, coming back to our main question - what forms of media businesses will be successful in the future? Answer: the ones with high Creative Density.

Let’s look at two highly successful modern media businesses to understand this point better - Acquired Podcast and Beast Industries. The former is a small media business that does at least $5M3 in revenue, the latter has become a media behemoth with about $700M in revenue, valued at over ~$5B. But there is one thing common to both - they are highly creatively dense.

Acquired is a podcast hosted by David Rosenthal and Ben Gilbert. Their revenue comes from a combination of streams - sponsorships (the title sponsorship for one season sells for >$2M), live events, speaking events and community passes. As per my research, the business does not employ more than 5-7 people, including the two hosts. That’s a revenue per employee of about $1M. Everyone in the company - the hosts, the audio engineer, the editors - moves the creative needle. No one only pushes paper.

Mr. Beast is the world’s biggest YouTuber. All his businesses collectively employ ~520 employees. Again, a revenue per employee of over ~$1M. Mr. Beast started his $5B business with a single YouTube video shot in his house. High Creative Density right from the beginning led to concentration of Distribution, and by extension massive concentration of value over time.

Mr. Beast’s example is especially instructive in showing the immense value of Distribution. What began as a YouTube channel, later spun off a chocolate brand that does ~$250M in revenue every year and is slated to grow rapidly. In the coming years and decades, a large amount of capital will chase concentration of Distribution, whether in Media or outside it.

This brings us to our last question:

What will be the role of capital in building and scaling media businesses?

Creativity, and Creative Density, in and of itself is not valuable. It needs a form-factor to scale and manifest in real world. Form factor is the medium through which creativity is expressed. Form factor can be an essay, a podcast, a video, a show, a film or even a consumer product, like Mr. Beast’s Feastables.

One of the trends that has led to shifting paradigms in Media is the decreasing cost of form factor. With generative AI, the cost of form factor will continue to reduce at increasing rate. To picture a media business in essence, imagine a dense creative core wrapped by a thin layer of form factor. The creative core is where the alpha is, which sucks all value, the wrapper - although important for scaling - is becoming commoditised and way less costlier. Therefore, a small capital towards the form factor can grow disproportionately over time, if it is wrapped around the right creative core.

Therefore, the role of capital in media businesses of the future will be to identify the right creative core and to allocate capital at the right pricing. Roll the clock back 12 years back when Mr. Beast had only 1000 YouTube subscribers. If an equity investor had taken a small $50k bet for 10% of Mr. Beast, it would be worth $500M today. There’s hindsight and survivorship bias at play here, of course, but one cannot deny that the next 5 years will present many such opportunities for early stage bet-takers if they look hard enough. Traditionally, early-stage media businesses have not been a favourite of venture capitalists. My contrarian bet is that it is bound to change, as other traditional VC-investible businesses - software, consumer products, consumer tech - become less and less venture investible.

Non-media companies, especially consumer-facing companies will increasingly begin investing in media and content to concentrate Distribution. With software and technology getting commoditised, Brand and Distribution will become better moats to bet on. Paying Meta and Google $1 to generate $3 of revenue is not a sustainable strategy over the long-term. Media and Content will go from a support function to a function of central importance in the next 5 years and beyond. Such companies will do better by following the same strategy as media companies - concentrate Creativity, invest in form-factor, and show patience.

Implications for creative professionals, investors and non-Media entrepreneurs:

Creative Professionals - Chase Creativity above everything. Over long enough time frame, your Distribution will converge around the level of your Creativity. If you are an agency selling creativity to other businesses, build your own distribution, and try to put your name on your creations as much as possible.

Investors - Develop an eye for Creative Density. Relook at media businesses. Even if you don’t, your non-media portfolio companies overtime will need to have a media company embedded inside them.

Non-media entrepreneurs - Focus on building long-term Distribution and Brand salience. It may be the last moat standing. Performance marketing will only go so far in helping you build a salient brand.

If you zoom out, and squint a little, the above discussion applies for the larger world as well. The distance between what’s in your mind and what you create in the world is greatly reducing. What lies between those two is your courage and agency. I firmly believe that the world is moving in the right direction. Creativity and agency have always been highly scarce human resources. Abundance of capital in the last decade or so hid this truth from us. God willing, the creative and the courageous will ascend.

‘Distribution’ is capitalized because I am using it in a specific sense: access to people, who are somewhat loyal to your content. To have Distribution is to have access to their attention.

‘Creativity’ is capitalized because I am using it in a specific sense: quality of content.

Nice article, Palash. I believe one of niches would be 'Travel vlogging through a personal creative touch'. Casey Neistat like cinematography (more static shots) + honest storytelling. Today's travel vlogs are too much focused on drone shots+aesthetics + itineraries as opposed to capturing the soul of a place. I write in my substack about my travel experiences. Soon, want to restart vlogging the way I explained above (have had many attempts previously. Will start again).

How do you see AI being used in this context? Do you see it only being used as a tool that merely builds what a creative person visualises or do you see it being used as a supplement to creativity itself?